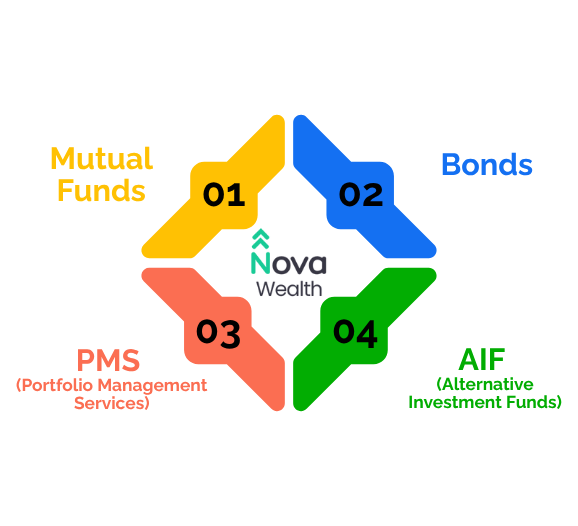

Maximize your returns with professionally managed mutual funds. Diversify your portfolio and invest with confidence. Whether you’re a beginner or a seasoned investor, we have the right fund for you.

Our portfolios blend a stable “core” of long-term investments with a dynamic “satellite” component focused on tactical opportunities. This structure maintains consistent returns while capturing market growth effectively through balanced diversification.

We design personalized strategies aligned with your financial goals — education, retirement, wealth creation, or legacy planning. Each portfolio follows a disciplined process that keeps your investments focused on achieving measurable, long-term outcomes.

We identify short- to medium-term market opportunities and reposition assets accordingly to enhance returns. By tactically adjusting exposure to equities, bonds, and alternatives, we capitalize on trends while maintaining disciplined risk management.

Our experts actively adjust portfolio weights across asset classes based on changing market conditions. This adaptive approach ensures optimal risk-reward balance, helping protect capital while maintaining growth potential through all economic cycles.

At Nova Wealth, insights drive every decision we make. We go beyond numbers to understand the forces shaping global markets, investor sentiment, and economic trends. Our approach blends data, experience, and foresight helping clients stay ahead in an ever-changing financial landscape.

By continuously monitoring market dynamics, asset performance, and emerging opportunities, we deliver intelligent strategies that balance growth with protection. Every portfolio we craft reflects a story of precision, adaptability, and purpose ensuring your wealth evolves with your ambitions.

Customized portfolio strategies tailored to individual financial goals and risk appetite.

Access professionally managed funds that balance growth, stability, and liquidity.

Stable, fixed-income instruments designed to preserve and grow capital.

Before making any investment decision, it’s essential to evaluate the following aspects:

Define short-, medium-, and long-term objectives clearly.

Understand your comfort level with market volatility.

Longer horizons allow better compounding and risk absorption.

Ensure part of your portfolio remains accessible for emergencies.

Balance between equity, debt, gold, and alternatives for diversification.

Consider taxation on returns, capital gains, and dividends.

Monitor and review performance periodically to stay on track.

Copyright © 2026 Nova Wealth. All Rights Reserved. Powered by Nazra Software Solution